Lessons from Volcanoes, the World Cup & Infrared Light

The tectonic shift in interest rates finally erupted in 2022, with several historic rate hikes that have significantly changed the investment horizon.

Introduction

Prior to its eruption on May 18, 1980, Mount St. Helens in southwestern Washington had lain dormant for over a hundred years. That morning, a 5.1 magnitude earthquake ignited a cataclysmic eruption that blasted ash and volcanic gas more than 80,000 feet high in less than 15 minutes, leaving a massive crater in its place, and removing more than 1,300 feet of the mountain’s summit elevation. The blast spanned over 200 square miles, triggered a devastating landslide that destroyed homes and bridges, and Mount St Helens’ plume of ash and debris spread across the entire Earth in only 15 days. To this day, the eruption remains the most destructive volcanic event in U.S. history.

While May 18 was a day of shock and awe, most people (unless they are geologists) may not be aware that Mount St. Helens continued erupting for years following the initial blast, with dozens of explosions from 1980 to 1986 that created a 900-foot dome of hardened lava on top of the crater floor. And if that isn’t mind-blowing enough, the 1980 blast wasn’t even the worst eruption in Mount St. Helens’ history (that occurred around 1900 BC for those keeping score).

Capital markets can have volcanic periods as well, and when the dust settles on the massive eruption that was 2022, there may be continuous seismic activity for years to come. The tectonic shift in interest rates, which ended a 40-year bull market in bonds and 13 years of central bank dovish policy, finally erupted in 2022, with several historic rate hikes that have significantly changed the investment horizon.

In Wilshire’s annual paper for “Non-Profit” clients1 we outline three strategic ideas to consider as we move into the years following the blast:

- Reconfirm Objectives: This Volcano May Keep Erupting

- Reimagine Asset Allocation: Build a World-Class Soccer Team

- Reveal Hidden Risks: Recalibrate Your Telescope

Reconfirm Objectives: This Volcano May Keep Erupting

Following the 2022 volcanic blast in capital markets that drove stock and bond values sharply lower, it is human nature to want to claw back lost gains and focus on peer-relative performance. Wilshire advises Non-Profits to instead adjust to our new reality and prepare for future seismic activity by reconfirming absolute return targets to drive asset allocation and portfolio decisions.

Most Non-Profits spend 4–5% per annum (p.a.) of an average market value (smoothed over historical periods), which creates nominal return targets in the 7–8% p.a. range, when factoring future assumptions for inflation and any fees or expenses. While many Non-Profit clients share similar characteristics, like time horizon and liquidity needs, each individual Non-Profit is unique and will have specific inputs to their return need. For example, some use 10-year-breakeven inflation as their inflation assumption, some may use HEPI (higher education price index), and some may use other metrics, like long-term averages. In any case, it is important to reconfirm the specific objectives of the institution, rather than focusing on more competition driven, peer-relative returns. This type of focus can often lead to a herding mentality or portfolio decisions that may not be appropriate.

As part of this reconfirmation of return targets, Wilshire encourages Non-Profits to revisit spending requirements to understand the portfolio’s ability to meet spending needs over the long-term. Monte Carlo simulations that run thousands of potential scenarios can stress-test long-term return targets based upon various levels of spending and inflation, or different spending calculation methodologies. This analysis can show the potential growth (or contraction) of spending and portfolio asset values well into the future, which will likely affect decision-making regarding a Non-Profit’s mission and vision.

Another part of reconfirming return targets involves reviewing the asset allocation to verify the portfolio’s ability to meet that target, as well as to understand the unique constraints for the institution, like liquidity needs for spending and cash management. For years, however, 7–8% has been a challenging bogie for Non-Profits to hit with a mix of traditional stocks, bonds, and alternatives because ultra-accommodative monetary policies by central banks led to asset values ballooning and fixed income yield compression. This is no longer the case given this “tectonic shift” in interest rates in 2022. Given the rise in yields, there may be opportunities for Non-Profits to minimize volatility for a given return target or maximize returns for a specific level of risk. For more than a decade, the trend among most Non-Profit clients was to reduce exposure to traditional assets like bonds and “hunt for yield” in other areas like alternative investments. But the aftermath of the eruption that was 2022 may now present opportunities for potential risk reduction (increasing fixed income) without having to sacrifice return potential. In other words, 2023 could be the beginning of a significant trend reversal. The chart below shows the tectonic shifts in required risk taking to achieve a 7% return target, with the proportion of stocks in a stock/bond portfolio dropping from 100% (to 65%) for the first time since the Global Financial Crisis (GFC), leading to the expected risk of the portfolio dropping by broadly one-third.

Regarding liquidity constraints, Non-Profits have a far longer investment time horizon than most investors. Small- and medium-sized Non-Profits in particular may have an opportunity to better exploit this through private assets where we see a number of attractive opportunities relative to public markets. But the sell-off in 2022, in both stocks and bonds, amplified the “denominator effect” for larger (actual) private markets allocations relative to target policies. Because of this, Wilshire encourages Non-Profits to review their private markets pacing schedules and overall liquidity needs to balance the potential opportunities we see in alternatives with the spending needs of the organization.

Reimagine Asset Allocation: Build a World-Class Soccer Team

Qatar 2022 may likely go down as the most exciting World Cup in history. Argentina and France played one of the most thrilling championship finals in the quadrennial tournament’s history, let alone the sport itself. After Argentina took a 2-0 lead going into the second half, France responded with back-to-back goals from Kylian Mbappé in a span of 90 seconds. Global superstars Lionel Messi and Mbappé exchanged goals once more in extra time before Argentina emerged victorious in a penalty shootout.

So yes, Wilshire caught soccer fever in 2022 — so much so that we began to think of asset allocation and portfolio construction in the same way as constructing an “optimal” soccer team, with Capital Growth serving as the quick and nimble offense, Income Generation as the balanced Midfield, and no surprise, Capital Preservation as our trusty defenders and goalie. Any soccer coach worth their salt knows that certain players may not be equipped to play the role they have in the past, while others may finally be ready to put some disappointing performances behind them and shine on the pitch. Therefore, Wilshire advises Non-Profits to have a clear portfolio purpose for their portfolio Offense, Midfield, and Defense (and of course it doesn’t hurt to have a few superstars like Messi and Mbappé on your team).

Offense: Give the Talented Rookie a Shot at Striker

Portfolio offense exists for one reason only — to score. Capital growth is vital for Non-Profits seeking to maintain the real purchasing power of their portfolios in perpetuity. Historically this role has been fulfilled by a trusted veteran (public equities) while for many Non-Profits the young, talented, albeit occasionally erratic young blood (private markets) has often been kept in a strong supporting role. We think it may be time to reverse those roles or at least review the allocation balance between the two. Non-Profits could also reconsider overreliance on portfolio “offense” for returns given the increasing relative abilities of “midfield” and “defense” to contribute to the team in the 2023 season ahead.

Public equities tripped on the pitch in 2022,and while market valuations have become less stretched following the significant drawdowns, this mainly reflects higher discount rates. An earnings recession has yet to be meaningfully priced into markets, and compared to historical valuations, public equity is not exactly cheap. In fact, relative to other asset classes, public equities are less attractive than they were at the start of 2022. The equity risk premium has contracted over 2022 to 1.60% as of December 31, less than half its historic average.

Finding a superstar striker, in our view, can better be achieved through exposure to a diverse range of targeted idiosyncratic opportunities within private markets:

- Select sector-specialist venture capital and buyout strategies that seek to capitalize on the multi-decade societal tailwinds within healthcare, technology, and industrials that have accelerated as a result of Covid-19 while benefitting from lower entry multiples following the sell-off in 2022

- Opportunistic and distressed credit strategies that seek to dynamically capture and benefit from mispriced opportunities, the supply of which has increased following the interest rate rises, high inflation, and potential recessionary headwinds that have arisen

With alternative asset classes, manager (player) selection is crucial to compensate for the additional liquidity risk of private markets versus public equity. Wilshire views its manager research teams as the inspired soccer scout and undertakes thorough quantitative and qualitative due diligence to select players that can deliver the intended portfolio outcomes mentioned above.

Midfield: Quick Passes for Quick Gains

The value of portfolio midfield for Non-Profits is the reliable provision of income without taking undue risk. Many Non-Profits have understandably cut their midfield (credit) allocation over time as available yields constituted increasingly small proportions of overall return need. But no longer.

Following a stark repricing over 2022, income yields in public credit markets are far more attractive than they have been in more than a decade, with U.S. corporate credit offering a cash yield of 5.10% p.a. as of December31, and high yield offering 9.65% p.a., finally living up to its name. For Non-Profits targeting nominal returns of 7–8% p.a., diversified public credit offers a far more appealing risk/return profile than public equities.

Duration and credit spread volatility, however, are likely to remain high for the foreseeable future and the risk of mark-to-market drawdowns is elevated. In light of this, Wilshire recommends the midfield make quick snappy passes — consider alternative credit and short duration options given the negative term premium currently priced into markets. Short- or floating-rate duration, high current income (5–15%+ p.a.), low default risk, and low correlation/beta to capital markets make alternative credit strategies highly attractive in our view. Wilshire views specialist asset-based lending, risk transfer strategies, intangible assets, and niche sector credit as potential stars of the midfield.

Defense: Good Goalies are Hard to Find

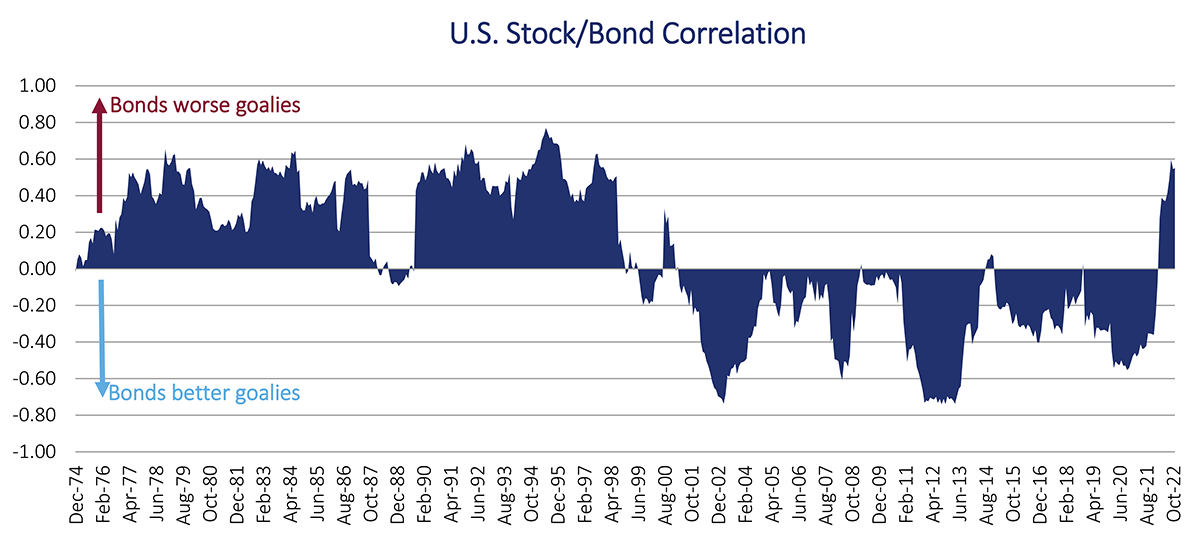

Who starts in goal? Bonds? Nominal bonds, especially long-duration bonds, fell by almost as much as stocks in 2022. Gold failed to meaningfully protect capital, as did TIPS, the Japanese yen, and other perceived safe-haven currencies. Current premiums on explicit equity market protection (puts) are prohibitively expensive for most investors. The U.S. stock/bond correlation across almost all trailing periods is now positive, and we remain skeptical of the ability of U.S. Treasuries to act as a reliable ballast to portfolio offense in 2023. In the near-term, the spike in inflation may continue to soften, but it is uncertain that CPI will fall back below 2.5% where stock and bond correlations tend to be negative2. Every market crash is unique but 2022 may lead to a greater re-think of portfolio defense than many crashes over the past 40 years. The below chart depicts why the standard Non-Profits goalie might need to be substituted out, i.e., the rolling 2-year correlation of U.S. stocks and bonds turned meaning fully positive in 2022 for the first time since the late 1990s.

So, what should Non-Profits do to defend against the Messis and the Mbappés of the risk world? In Wilshire’s view, diversifying marketable alternatives with low correlations and beta to risk assets that are unconstrained across asset class and direction (long/short) are increasingly worthy of inclusion in a portfolio’s defensive lineup. While underlying strategies vary in expected returns, correlations, and downside protection offered, they can be combined to provide effective portfolio defense and can be tailored in the trade-off between return expectations and downside protection. Specifically, this trusty defense may include trend following, long volatility, and global macro strategies that tend to outperform in volatile periods — like nail-biting penalty kicks. The chart below shows the performance of U.S. stocks, Treasuries and an equal-weighted blended alternatives basket of trend-following, global macro and volatility strategies over market crisis periods from the GFC through 2022. This shows the huge deterioration of capital protection offered by Treasures in 2022 versus all other periods and how diversifying alternatives significantly protected capital. In other words, it might be time to consider a new goalie.

Reveal Hidden Risks: Recalibrate Your Telescope

A new era of astronomy dawned in July of 2022 when NASA released the first set of scientific images from the James Webb Space Telescope. Like everyone who witnessed the celestial pictures, Wilshire was awestruck at the beauty and exquisite detail of these distant galaxies over hundreds of millions of light-years away and beyond. After the initial period of amazement finally wanes, the next question that one might logically consider is “how was this even possible?"

The answer is infrared light. Unlike the Hubble Telescope, which has been orbiting our planet for the past 30 years, that detects mostly visible light, the Webb Telescope seeks invisible, infrared light from its orbit a million miles away.

Infrared light enables it to illuminate these brilliant photographs of galaxies far, far away, and gives humankind a vivid glimpse into how the universe may have taken shape almost 14 billion years ago.

This new way of using what is invisible to the naked eye sparks the imagination of what we might be missing as investment advisors to our clients. What risks might not be visible or fully tangible? We believe two might not be fully uncovered (yet) — implementation risks and Environment, Social and Governance (ESG) risks.

We know that, at the total portfolio level, asset allocation drives 90% of portfolio return variability and active manager decisions drive a much smaller percentage. Conversely, many Non-Profits spend the bulk of their time on investment manager sourcing, selection, and monitoring. Wilshire encourages Non-Profits to evaluate their governance arrangements to determine whether sufficient resources are available for both high impact asset allocation/portfolio construction decisions as well as investment manager due diligence. For Non-Profits with limited staff or resources, or infrequent meetings with jammed agendas, it may be appropriate to consider Outsourced Chief Investment Officer (OCIO) solutions for part or all of your portfolio. Like Webb’s infrared technology, there might be opportunities with OCIO to uncover the unknown — potentially ways to lower investment management fees, enhance operational oversight, and add more diversification while freeing up more time to focus on decisions that really move the needle (like building a “world-class soccer team” portfolio).

Another risk that can feel invisible at times is ESG. Part of the reason is the way Non-Profits address ESG varies significantly; there is no single “right” approach. Some investors advocate for divestment while others look to integrate ESG risk management within their current program, and some may source more impact-specific investment strategies. For many Non-Profits considering climate risk, the reality is there is no easy path to a net-zero carbon emissions future.

It is no wonder, therefore, that Non-Profit surveys indicate well over half of organizations have yet to implement ESG risk mitigation strategies within their portfolios3. So, how can Wilshire help clients use our (metaphorical) infrared technology to uncover and understand these otherwise “invisible" ESG risks? Perhaps ESG progress can best be described through an actual example.

Over the past several years, one of our University Foundation clients found itself stuck between a proverbial rock and hard place: a highly engaged student body requesting immediate divestment from fossil fuel companies, and an alumni base that had a high percentage of energy sector careers that wanted nothing to do with divestment. Wilshire helped the board and staff balance this conundrum by providing additional education on ESG to all stakeholders. Wilshire assessed various exposure levels to carbon within the existing portfolio, helped the board and student representatives understand the spectrum of ESG approaches (from divestment to integration to impact), and established a data-driven path for integration throughout the portfolio.

The University Foundation took a very deliberate decision not to either 1) do nothing or 2) divest. Instead, the process involved revising the Investment Policy Statement to clarify specific ESG goals, establishing regular measurement of the portfolio’s carbon intensity footprint, and evaluating how existing active managers consider and integrate climate risk and environmental stewardship into their decision-making process. While ESG risks and climate transition are long-term in nature, the University Foundation improved its governance structure around these risks and is making progress in the near-term. The visual spectrum of the Foundation’s ESG approach is now much wider. Sometimes you just have to look through a recalibrated telescope to see things more clearly.

Conclusion

Looking back on 2022, central bank policy ignited a dormant interest rate volcano that has the potential to spark eruptions for years to come. To prepare for 2023 and beyond, Wilshire encourages Non-Profit clients to reconfirm their strategic goals and spending needs, and to stress test those results, so the institution is strongly positioned for its long-term mission and vision. The asset allocation policy should be reviewed as well, to make sure its offense, midfield, and defense are as talented and well-balanced as France and Argentina were in that unforgettable World Cup final. And finally, we encourage our clients to always look through recalibrated telescopes, because there may be risks in the portfolio that aren’t visible with just the status quo. An OCIO solution may be ideal for all or part of your portfolio; and while ESG risks are long-term and still emerging, there are still actions investors can take to improve outcomes. Wilshire’s goal as a trusted advisor to our clients is to use new ideas and technology, like Webb’s use of infrared light, to help clients uncover risks through thoughtful ideas, collaboration, and education so our Non-Profit clients can continue to serve their communities for many (light) years to come.

Endnotes

1 Non-Profits are broadly defined as institutions with ultra-long-term pools of capital.

2 Rolling 3-year U.S. Stock-Bond correlations from January 1960 to August 2022. Stock-bond correlation is between the S&P 500 Total Return and the Bloomberg Barclays US Treasury Aggregate Total Return Indices.

3 CCSF 2021 Study of Investment of Endowments for Private and Community Foundations, NACUBO-TIAA 2021 Study of Endowments

Important Information

Wilshire is a global financial services firm providing diverse services to various types of investors and intermediaries. Wilshire’s products, services, investment approach and advice may differ between clients and all of Wilshire’s products and services may not be available to all clients. For more information regarding Wilshire’s services, please see Wilshire’s ADV Part 2 available at www.wilshire.com/ADV.

Wilshire believes that the information obtained from third party sources contained herein is reliable, but has not undertaken to verify such information. Wilshire gives no representations or warranties as to the accuracy of such information, and accepts no responsibility or liability (including for indirect, consequential or incidental damages) for any error, omission or inaccuracy in such information and for results obtained from its use.

This material may include estimates, projections, assumptions and other "forward-looking statements." Forward-looking statements represent Wilshire's current beliefs and opinions in respect of potential future events. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual events, performance and financial results to differ materially from any projections. Forward-looking statements speak only as of the date on which they are made and are subject to change without notice. Wilshire undertakes no obligation to update or revise any forward-looking statements.

Wilshire Advisors, LLC (Wilshire) is an investment advisor registered with the SEC. Wilshire® is a registered service mark. Copyright © 2023 Wilshire. All rights reserved.

MM-333572 E1223